The differences in regulatory capital requirements for the.

Starting with the Basel Concordat, first issued in 1975 and revised several times since, the Committee has established a series of international standards for bank regulation, most notably its landmark publications of the accords on capital adequacy which are commonly known as Basel I, Basel II and, most recently, Basel III.

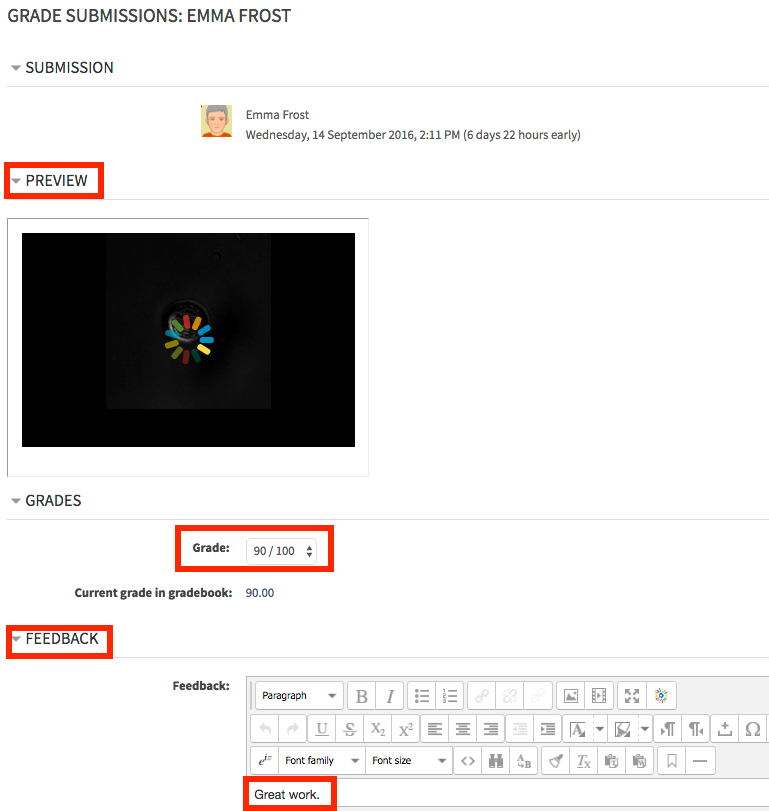

This is the most comprehensive presentation on Risk Management in Banks and Basel Norms. It presents in details the evolution of Basel Norms right form Pre Basel area till implementation of Basel III in 2019 along with factors and reason for shifting of Basel I to II and finally to III. Links to Video's in the presentation Risk Management in Banks.

Basel 3 capital requirements - overview and critical evaluation - Oliver Baumgartner - Seminar Paper - Business economics - Banking, Stock Exchanges, Insurance, Accounting - Publish your bachelor's or master's thesis, dissertation, term paper or essay.

Money and Capital Market (Economics Essay Sample). Check Out Our Money and Capital Market Essay. Basel III is a regulatory standard on the capital adequacy of banks. There are various reasons as to why the regulators decided to move from Basel II to Basel III. In the late 2000s, it was clearly evident that there was a global deficiency in.

Basel I is a set of international banking regulations put forth by the Basel Committee on Bank Supervision (BCBS) that sets out the minimum capital requirements of financial institutions with the.

Basel Accord: The Basel Accords are three sets of banking regulations (Basel I, II and III) set by the Basel Committee on Bank Supervision (BCBS), which provides recommendations on banking.

BASEL III 2 BASEL III Explaining the contents of BASEL III As an all-inclusive set of reform strategies, BASEL III was designed by the Basel Committee on Banking Supervision (BCBS) with the primary objective of strengthening the risk management, supervision, and regulation of the banking sector. The aim of these measures is to enhance the ability of the banking sector to absorb shocks emerging.

Why BASEL? What is BASEL? What are BASEL Capital adequacy requirements (CAR)? BASEL-III norms; Criticism of BASEL norms; Why BASEL? 2007-08: Subprime crisis in USA, after their banks loaned money to “subprime” borrowers i.e. people without capacity to repay the loan. The resultant housing bubble and its collapse, led to economic downturn throughout the world.

In the morning I bathe my intellect in the stupendous and cosmogonal philosophy of the Bhagvat-Geeta, since whose composition years of the gods have elapsed, and in comparison with which our modern world and its literature seem puny and trivial; and I doubt if that philosophy is not to be referred to a previous state of existence, so remote is its sublimity from our conceptions.

Moody’s Analytics provides financial intelligence and analytical tools supporting our clients’ growth, efficiency and risk management objectives. We are recognized for our industry-leading solutions, comprising research, data, software and professional services, assembled to deliver a seamless customer experience.

Nature Of The Banking Business Essay. 5117 words (20 pages) Essay in Business.. a new Capital Accord called Basel II was introduced in June 2004. The provisions of this Accord were included in the European legislation in 2007; main idea was to change and improve existing EU derivatives.. In Basel III, task is to absorb and make less.

Agronomy, an international, peer-reviewed Open Access journal. Powdery mildew (Erysiphe necator) is a fungal disease causing significant loss of grape yield in commercial vineyards.The rate of development of this disease varies annually and is driven by complex interactions between the pathogen, its host, and environmental conditions.

The Middle East and North Africa (MENA) is an economically diverse region that includes countries with a common heritage, vastly different levels of per capita income, and a common set of challenges (see Box 1).Historically, dependence on oil wealth in many countries and a legacy of central planning in other countries have played major roles in shaping the region's development strategies.